Travel Insurance for Nepal

Table of Contents

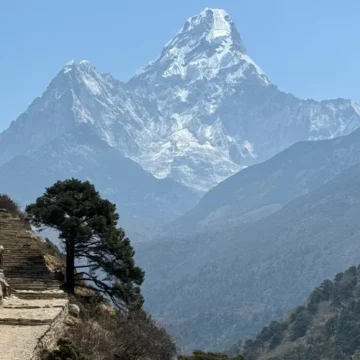

Travel insurance is a shield for all those travelling to Nepal who want to safeguard themselves against unexpected events. Be it a trek to the Himalayas or a visit to cultural sites for medical necessities, trip abortions, or loss of luggage, among others. These all are covered by travel insurance. It makes provision for your financial needs in case you require medical treatment from an area that is hard to access. Or if your expedition is cut short for whatever reason. This coverage enables you to live in Nepal to the fullest. With security, you will have responsive support no matter how far you go.

Do you need travel insurance for Nepal?

Yes, you do; you really do need travel insurance for Nepal. For this reason, travel insurance is crucial since it encompasses various factors beyond your control while travelling. Nepal is a multi-terrain country with present features like mountains, hard-to-reach areas and cities. Tourist activities such as trekking, mountaineering, and paragliding, being associated with certain risks, are pretty adventurous. Travel insurance for Nepal helps guarantee medical care costs. For example, accidents, illnesses, or injuries are affordable without leaving you financially strained. It also encompasses issues concerning evacuation, which might cost a lot of cash in scenarios such as mountainous areas.

The other general areas travelling insurance addresses are trip cancellations, lost luggage and travel delays. However, the Nepalese weather is very volatile, and the most unexpected changes can occur in the most unplanned ways. Insurance comes in handy. If a flight has been cancelled and a person does not make a connecting flight because of the weather conditions, the other costs will be covered. General damages are usual when travelling. For example, when a passenger loses luggage or some valuable items, insurance is available to offer compensation. So, having travel insurance for the trip to Nepal is wiser as it assures you of a worry-free trip.

What does travel insurance cover?

Travel insurance generally covers situations you can encounter while travelling and has provisions for them if they happen to you. It eliminates the chances of the traveller facing hefty financial losses in case of an accident during travel. Thus, the traveller can effectively enjoy their travel plan.

Here are some of the critical areas it typically covers:

Medical Emergencies and Evacuation: This helps repay the charges related to the treatment if you fall ill or encounter an accident during the travel. Proposes reimbursing the amount spent on transport to the nearest appropriate medical centre. Or at home if the patient needs to be discharged.

Trip Cancellation: If you cancel your journey due to sickness, physical injury, or the death of a relative, you will be reimbursed the prepaid, non-reversible costs.

Trip Interruption: Pays for the rest of a trip if it is not completed due to covered reasons and extra costs that may be incurred.

Lost, Stolen, or Damaged Luggage: This policy compensates you for the worth of the items if your luggage gets lost or stolen or if you are in a poor state while on a journey.

Delayed Baggage: Delivers money to buy necessary things if your baggage arrives after several hours/days.

Flight Delays: Pays for lodgings and food if your flight is delayed for several hours.

Missed flights: Compensates you for the expenses of making up for your trip in case a delay makes you miss the connecting flight.

Accidental Death and Dismemberment: Offers benefits to your beneficiaries in the unfortunate event that you die or you get incapacitated, for example, through an accident while on a trip that results in the loss of a limb.

Emergency Assistance Services: A hotline is available 24/7 to ensure you get the necessary medical referrals, travel bookings, and assistance with any emergency while on the trip.

Required Documents for Travel Insurance for Nepal

- Passport Copy: Please provide a clear copy of your valid passport. This will help the insurance company verify your identity and travel details.

- Travel Itinerary: Your detailed travel itinerary, including flight details, accommodation bookings, and planned activities. This information helps insurers understand the duration and nature of your trip.

- Proof of Address: A recent utility bill, bank statement, or other official document showing your current residential address.

- Health Declaration: A form declaring any pre-existing medical conditions. Some insurers may require a medical certificate from your doctor, especially if you have a history of health issues.

- Payment Information: Details of your preferred payment method (credit card, bank transfer, etc.) for paying the insurance premium.

Steps to Obtain Travel Insurance for Nepal

- Research and Compare: Compare policies from different insurance providers to find the best coverage.

- Fill Out the Application Form: Complete the insurance application with all necessary details. This can often be done online.

- Submit Documents: Upload or email the required documents as specified by the insurance provider.

- Review and Confirm: Review the policy details and ensure all information is correct before confirming the purchase.

- Make Payment: Pay the insurance premium using your preferred payment method.

- Receive Policy: Once payment is confirmed, you will receive your insurance policy documents via email or mail. Keep a copy with you while travelling.

Types of Travel Insurance in Nepal

Medical and Health Insurance

Health and medical insurance shield the cost of treatment you might require during your trip, such as hospitalization. Medical evacuation means you get all the health care you need. And do not have to worry about fees, especially in Nepal’s distant and mountainous areas.

Travel Cancellation Travel Insurance

Trip cancellation and interruption insurance pays for the money you lose on non-refundable arrangements. If you cancel or shorten your trip due to illness, natural disasters, or travel advisories. It will protect your money, especially when you spend it on travel.

Emergency Evacuation Insurance

Such evacuation insurance pays for moving you from your current location to a hospital that can handle your medical condition or from a high-altitude area if needed. That is why it plays a crucial role in minimizing the risks. Exposure incurred in trekking and adventurous activities in the mountains of Nepal.

Adventure sports insurance

Adventure sports and activities insurance covers people going on risky projects such as trekking, mountaineering, and flying. It includes, and only covers, injuries, medical emergencies, and helicopter evacuations in adventurous activities.

Personal Liability Insurance

This policy will expand your defence costs and compensate for any accidental physical harm or property damage for which you are held legally responsible while on your journey. It funds legal defence and compensation claims to third parties, clients, and institutions.

Luggage Insurance

Baggage and personal belonging insurance cover the cost of lost, stolen, or damaged luggage and personal and travel documents. It assists in procuring some of the necessary items during travelling, reducing the loss in case of an accident.

Cost of Travel Insurance for Nepal

Below 3,000 Meters (9,800 Feet):

- Basic medical coverage typically starts from USD 50 to USD 100.

- Trip cancellation and interruption insurance ranges from USD 50 to USD 150.

- Coverage for adventure moves such as trekking and cultural tours generally falls within USD 50 to USD 200.

3,000 to 6,000 Meters (9,800 to 19,700 Feet):

- Medical and health insurance costs increase due to higher risks associated with altitude sickness and limited medical facilities.

- Expect to pay between USD 100 and USD 300 for comprehensive medical coverage, including emergency evacuation if necessary.

- Insurance specifically covering high-altitude trekking routes, such as Travel insurance for Everest Base Camp or Annapurna Circuit, may range from USD 200 to USD 500, depending on the extent of coverage and evacuation services.

Above 6,000 Meters (19,700 Feet):

- Insurance costs significantly rise due to extreme altitude conditions and the need for specialized emergency evacuation services. Coverage for altitudes above 6,000 meters can range from USD 300 to USD 1,000 or more, ensuring comprehensive medical treatment and evacuation from remote, high-altitude locations like Everest or other Himalayan peaks.

Helicopter Evacuation Insurance in Nepal

Emergency helicopter evacuation insurance in Nepal is crucial for travellers, especially those trekking in remote areas with limited access to medical facilities. The price of this insurance can vary depending on several factors, such as the duration of coverage, the specific trekking route or region, and the level of coverage provided.

Emergency helicopter evacuation insurance typically covers the cost of helicopter rescue and evacuation to the nearest medical facility in case of extreme illness or injury during trekking or mountaineering expeditions. This insurance ensures prompt access to medical care in remote and rugged terrain where ground transportation is impractical or unavailable.

Nepal’s emergency helicopter evacuation insurance cost can range from USD 100 to USD 500 or more for short-term coverage, depending on the insurance provider and the extent of coverage offered. It is advisable to choose a reputed insurance company specializing in adventure travel insurance that provides precise details about coverage limits, exclusions, and procedures for activating emergency evacuation services.

Travel Insurance For Schengen Visa In Nepal

Above 6,000 meters can cost between 300 and 1000 or more USD for medical treatment and evacuation from high-altitude mountains like Everest or other Himalayan mountains. Schengen visa insurance is necessary and compulsory when applying for a Schengen visa for Nepal.

It affords all-encompassing coverage during your trip to Schengen countries, specifically for medical bills, emergency medical evacuation, repatriation of remains, and trip interruption or cancellation. This insurance satisfies Schengen visa regulations and provides coverage in case certain situations occur that would interfere with your journey. It is a tool that can be a lifesaver when travelling across Europe because it guarantees protection in the event of an unfavourable occurrence.

Travel Insurance for USA Visa in Nepal

While processing the visa to visit the USA from Nepal, travel insurance is usually recommended and mandatory. This insurance covers medical expenses, emergency medical evacuation, arrangement of funeral services where necessary, and prepaid expenses in case of trip interruption or cancellation.

Some of the benefits include the fact that it acts as an insurance policy since you can be financially vulnerable during your stay in the United States. This insurance fulfils the visa requirement and leaves you worry-free as you engage in various endeavours in the USA.

Travel Insurance for hiking in Nepal

Hiking travel insurance is necessary for trekkers to wander through Nepal’s steep terrains. Travel insurance for trekking in Nepal provides vital coverage for probable risks experienced during hiking activities within the Himalayas. This particular insurance is designed to protect individuals against other health complications, such as altitude sickness or any other related mishaps.

Insurance for trekking in Nepal entitles you to appropriate medical care and evacuation if necessary. It also covers trip delays, cancellations, and lost or stolen items, which can be very comforting during your hiking experience. When you take hiking travel insurance, you can explore Nepal’s beautiful terrains and natural bowls while being equipped and ready for any trial on the hike.

Best Travel Insurance for Nepal

Choosing the best travel insurance for Nepal involves considering reputable providers known worldwide for comprehensive coverage and reliable customer service. Here are some top options:

- World Nomads: World Nomads is famous for its specialized adventure travel coverage, which includes trekking and hiking in Nepal. It offers flexible policies and excellent customer support.

- Allianz Global Assistance: It has a range of plans with extensive coverage options, including medical emergencies, trip cancellations, and baggage loss.

- AXA Assistance: AXA Insurance provides robust travel insurance plans with coverage tailored to various adventure activities, including trekking and mountaineering in Nepal.

- Travel Guard: Travel Guard has comprehensive plans with 24/7 assistance services that cover medical emergencies, evacuation, and trip interruption.

- InsureMyTrip: A comparison website that compares multiple travel insurance plans from different providers, helping you find the best coverage for your specific needs in Nepal.

Travel Insurance for Nepalese Citizens

Overseas travel insurance is very important for Nepali citizens and protects them against any incident in foreign countries. This insurance mainly deals with health complications like hospitalization and delivery of services needed during your travels. It also has features like cancellation or interruption of a trip, reimbursement for lost or stolen items, and liability.

With travel insurance, Nepalese citizens can be assured that they have a backup in terms of monetary support and assistance if there are unfortunate incidents that may happen during their adventures to different parts of the world. This measure protects the travelling individual and enables them to have an enjoyable trip, knowing they shall not face so many adversities.

Travel health insurance companies in Nepal:

- Sagarmatha Insurance Company Ltd.

- Shikhar Insurance Company Ltd.

- Neco Insurance Company Ltd.

- Himalayan General Insurance Company Ltd.

- United Insurance Company (Nepal) Ltd.

- Siddhartha Insurance Ltd.

- Nepal Insurance Company Ltd.

- Everest Insurance Company Ltd.

- Premier Insurance Company (Nepal) Ltd.

- National Insurance Company Ltd.

Want to know more?

Speak to an Expert

Sandip Dhungana

Nepal 🇳🇵

Whatsapp: +977-9823636377

Leave Your Comment